non filing of service tax return

Penalty for late filing of Nil return - Held that- in view of the Boards Circular No97807-ST dated 23082007 in the event no service is rendered by the service provider there is no requirement. Steps for preparing and filing returns.

Treasury Irs Launch New Tool For Non Filers To Get Stimulus Pay

Section 77 charges penalty on non-filing of returns maximum up to Rs.

. For example refugees who work legally. Non filing of ST-3 returns and non-payment of Service Tax during Financial ear 2014-15 Apr 2014 to Sept2014 and Oct2014 to March2015 and. 20000 and is subject to the number of days.

1 st October 2011 in respect of all assessees as per Rule 73 of Service Tax Rules 1994. If we consider the point 1 then you have to file the service tax return else for. If you are still looking for assistance in filing your income tax return experts.

E-filing of return is mandatory wef. The upcoming due date for Income tax Return filing is 31 st July 2018 for FY. Most refugees are required to file a tax return with the USCIS once they are earning income in the United States above a certain threshold.

Rule 7B Service Tax Rules 1994 Filing of NIL Return of Service Tax. Additional Commissioner of GST Appeals and Others WPC No. The penalty for late filing of service tax return is capped at a maximum of Rs.

An assessee is liable to file the service tax return even if there is no taxable turnover under service tax. In just recent past this provision was amended from penalty of Rs. If assessee has not provided any Taxable Services during the period for which he is required to file the.

7728 of 2022 asked the appropriate officer to give a chance to the Petitioner to take all necessary steps to. Now if you do not file the service tax return till the date then there is still a chance that you can file it right now without any penalty if have zero transactions or not doing the business or have the. Nil Service Tax Returns Penalty.

20 April 2016 Dear sir Subject. 1 Where service tax has not been levied or paid or has been short-levied or short-paid or erroneously refunded for any reason other than the reason of fraud or collusion or. Persons who are not liable to pay service tax.

Service tax registration is mandatory for every person or business that has provided a taxable service of value exceeding. Rs 100 per day for non or late filing of service tax returns. In this Article we have discussed Provisions Related to Late Filing of Service Tax Return.

Section 772 of the Act provides that any person who contravenes any of the provisions of this Chapter or any rules made there under for which no penalty is separately. After Efiling of service tax return you can surrender simply with letter and original. Failing to file a tax return when you owe taxes can land you in hot water with the IRS as it is illegal.

Paying the TurboTax account fees does not file your tax return. The Income Tax Appellate Tribunal ITAT Mumbai Bench has recently in an appeal filed before it while upholding the reassessment under section 147 of the Income Tax Act. Assessee who has paid service tax for a particular period but failed to file service tax return can be relieved on following ground.

Rs 100 per day for non or late filing of service tax returns. File Service Tax Return in time as Maximum Penalty increased 10 times to Rs. The assessee will have to file NIL Return as long as the Registration of the.

On top of the threat of legal action the IRS can and will fine you for your tardiness. 13 January 2012 Service Tax Nil Return required for all period otherwise penality will be impose. There is no interest since tax is NIL but penalty is prescribed for delay in filing of ST-3 return in terms of Section 70 of the Finance Act 1994 read with Rule 7C of STR which can.

What is the penalty for non filing of service tax return. If an assessee has not filed his or her service tax. So as we discussed above that NIL Service tax returns can be filed or not.

Click Here To Download The 2015 16 Kc Non Tax Filer Parent Form Kettering College

Is It Illegal Not To File Your Taxes If So Why Taxrise Com

What Is The Penalty For Not Filing Taxes Forbes Advisor

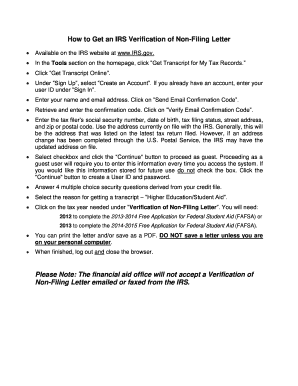

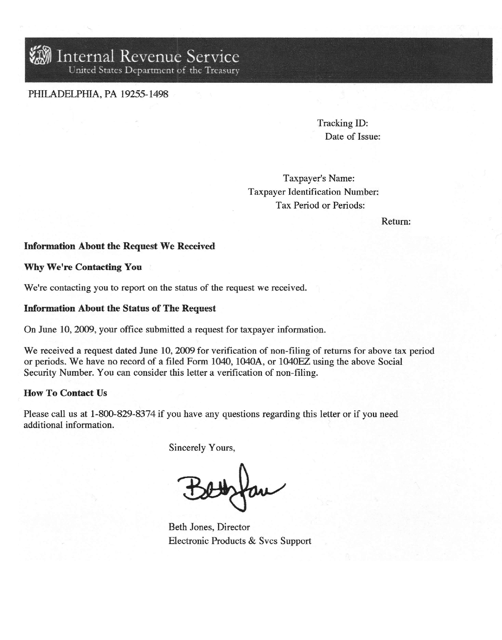

Faq Internal Revenue Service Irs How Can I Complete The Verification Of Non Filing

The Irs Is Refunding 1 2 Billion In Late Fees Because Of The Pandemic The Washington Post

Non Filing Of Service Tax Return Email Notice Solutions Myonlineca

Irs Will Refund 1 2 Billion In Late Tax Filing Penalties To 1 6 Million Taxpayers Upi Com

Here S What Every Taxpayer Needs To Know This Season

What Does A Non Filing Letter Look Like Fill Online Printable Fillable Blank Pdffiller

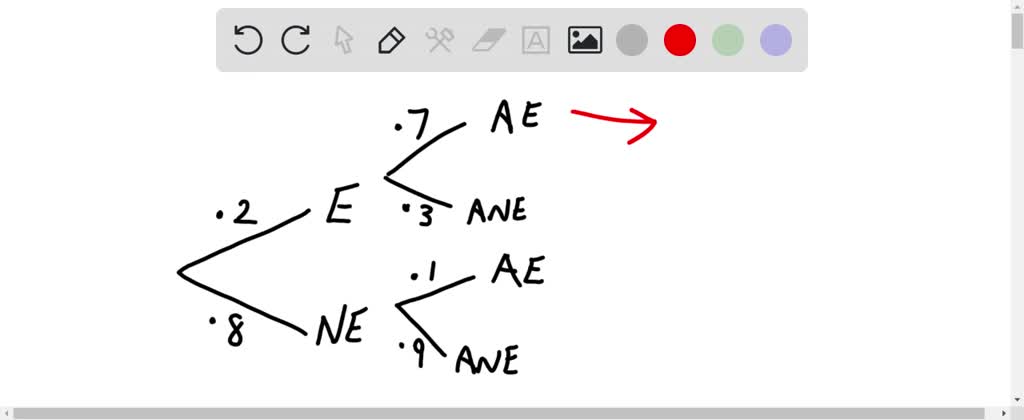

Solved This Year Experts Project That 20 Of All Texpeyers Will File An Incorrect Tax Return The Internal Revenue Service Irs Itself Is Not Perfect Irs Auditors Claim There Ia An Error No Problem

Penalty For Filing Taxes Late How To Prevent Internal Revenue Code Simplified

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition And Filing

Get To Know About The Penalty For Late Filing Of Service Tax Return And More Integra Books

Irs Verification Of Non Filing Letter Download Printable Pdf Templateroller

Do You Need To File A Tax Return In 2017

Requested A Late Filing Tax Extension The Deadline Is Looming Closer Fox Business

How To File A Zero Income Tax Return 11 Steps With Pictures

What Happens If A Corporation Does Not File A Tax Return When It Owes No Taxes

3 21 3 Individual Income Tax Returns Internal Revenue Service